Driving Organizational Growth by Building Vision-Aligned and Accountable Teams

At The Halpin Companies, we empower COOs within the educational & healthcare sectors to build a solid foundation for their organizations rooted in people.

- With the right people,

- With the right strengths,

- In the right roles, you will achieve record results.

Less

hands-on management

More

time for strategic initiatives

Exponentially Greater

financial results

Leadership is not about micromanagement or losing sleep over your team's performance.

It’s about creating a secure environment where people can be self-led to help you deliver the highest quality value to your students, patients & customers or stakeholders.

However, it’s not easy & the journey is full of challenges:

You find yourself constantly immersed in a day-to-day micromanagement.

Your teams are not autonomously reaching their peak performance.

All available data shows your organization’s untapped potential for much greater success.

We understand.

That’s why we are here to help you create high-performing teams, enhancing their effectiveness and aligning them with your vision so you can easily focus on more strategic endeavors & move your organization forward.

Successful organizations with outstanding teams aren’t randomly created, they are carefully designed

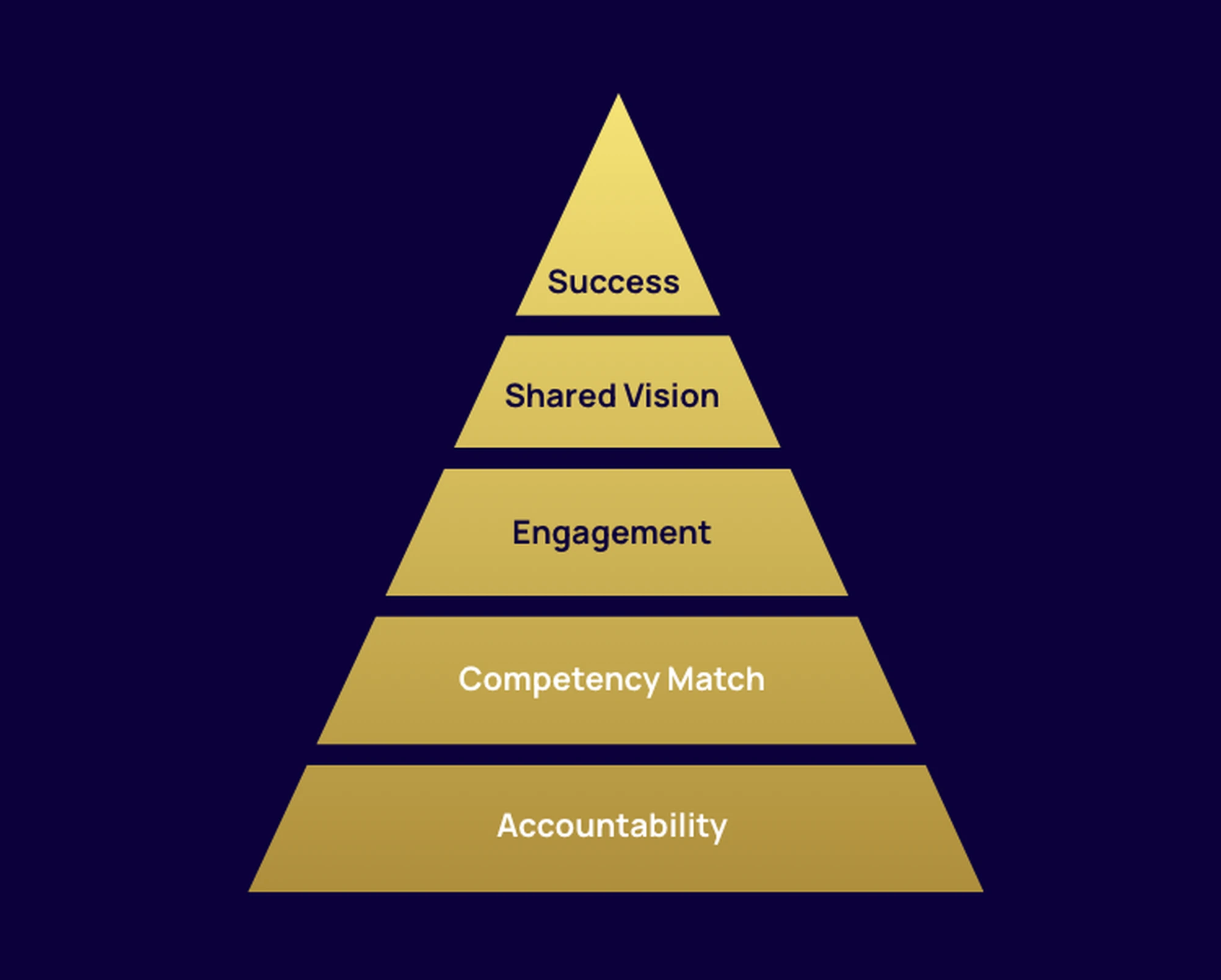

Our unique approach, refined over the years, involves a proven framework that enhances employee accountability immediately.

It helps you align their strengths with the right role and fuel their engagement.

As a result, this leads to seamless alignment with your vision and propels your organization towards success.

Once applied, our framework

becomes an integral part of your organization.

Building a solid foundation isn't a walk in the park, but with support, growth is inevitable

Book a call with me to see how you can quickly & effectively apply changes within your teams to move your organization forward.

Book a Call

Schedule a 30-minute confidential & complimentary call with me and tell me about your needs, struggles and the people you work with.

Get ready to implement your new strategy

Acquire an easily implementable strategy and explore swift approaches to instill accountability right from the start. Witness immediate results from day one.

Redirect the course for growth

Let us guide you through a step-by-step implementation of organizational improvements so you can accelerate and amplify your success.

I guarantee that this call will redefine how you perceive individuals within your organization and show you possibilities of tapping into their potential.

Testimonials

“Katherine Halpin brings value to any business application that involves working smarter and achieving superior results. I have worked with her in two different trade associations and she brought tremendous value to our team and our team building efforts.

I have found her to be incredibly intuitive about people and have witnessed her amazing results in helping people either step up or step out.

She also has an innate strategic sense and has helped our teams really focus on strategic issues instead of getting mired in tactical plans.

I highly recommend her for her Leadership Coaching for both individuals and organizations.”

Lisa McGreevy McGlynn

“The sessions that Katharine led for our department at Cancer Treatment Centers of America not only helped strengthen and grow our team, they also translated to all areas of my life.

You cannot be in her presence without being inspired to excellence through her presentation style, her energy and her knowledge.

She gently leads you through a series of self explorations that brings professional and personal growth.

One-on-one follow-up calls brought focus, grounding and insight that I still reflect on today.

Thank you Katharine for the important work you do to drive team alignment and strategy as well as personal reflection and growth. I strongly recommend any company or group to learn about the individual and group benefits you will find through coaching with Katharine Halpin."

Jennifer Kehren

“Katharine is an experienced business professional and coach. She helped me attain higher levels of performance personally and with my organization using her simple tools in a very short period of time. Katharine has kept me up to date through her alumni communications. I appreciate that the coaching did not end with the contract - it is truly a long term commitment from Katharine and value to me.

Lisa Schuldes

“When I first heard Katharine I thought, "Wow! This is juicy stuff!" Her 8 tips for time management are dead on. She knows it's not just about managing time, but making time work for us. Love her approach, love her passion, and love her strategies!”

Layne Gneiting, PhD

As a board member, I wanted to formally recognize Katharine’s leadership in pulling together a diverse group of 18 people in a multi-hour zoom meeting. The interactive strategic planning workshop she facilitated addressed complex territory including driving closure on several mission-critical decisions that will impact the sustainability of our organization. The very thorough preparatory work, setting clear expectations with a robust agenda and holding us accountable to action items contributed to us executing to plan. It was a pleasure to watch her Mississippi storytelling style in action; firm and assertive yet all our voices felt heard. Strategic facilitation - that’s her jamm.

Mary E. Maloney, FACHE

Become the architect of your organization’s growth

Brick by brick, we will help you:

Engage employees at every level

Become the employer of choice

Build a transparent organization

Retain & develop the best employees

What makes us stand out?

GROWTH MINDSET translated into action

Leadership isn't only about doing the right things; it's also about thinking in the right direction. We will help you become a growth-oriented leader who can easily apply the required actions and move your company towards success.

CLEAR EXPECTATIONS

for fast accountability

We understand the urgency of results, and our methods ensure that accountability swiftly integrates into your team culture, emphasizing the importance of transparent goals, responsibilities and communication, delivering measurable results within the first week.

TAILORED APPROACH

for sustainable success

Our approach is not just about the quick win – it's also about crafting a journey tailored to meet your teams' specific needs and nuances, ensuring sustainable growth for your organization.

People are the driving force for your company

Make sure you have the right ones on board

Hi, I’m Katharine Halpin, a Founder & CEO of The Halpin Companies.

We empower organizations in the educational and healthcare sectors to increase their revenue exponentially, while solving leadership and management challenges.

We know that the secret to accelerating organizational growth lies in placing the right people with the right strengths in the right roles, fostering innovation and driving organic growth.

Our approach is designed to transform you not only into a successful leader who fuels their passion but also into a fulfilled individual who doesn’t stress about the future growth of their organization.